tax break refund tracker

Taxpayers on the go can track their return and refund status on their mobile devices using the free IRS2Go app. Lets track your tax refund Once you receive confirmation that your federal return has been accepted youll be able to start tracking your refund at the IRS Wheres My Refund.

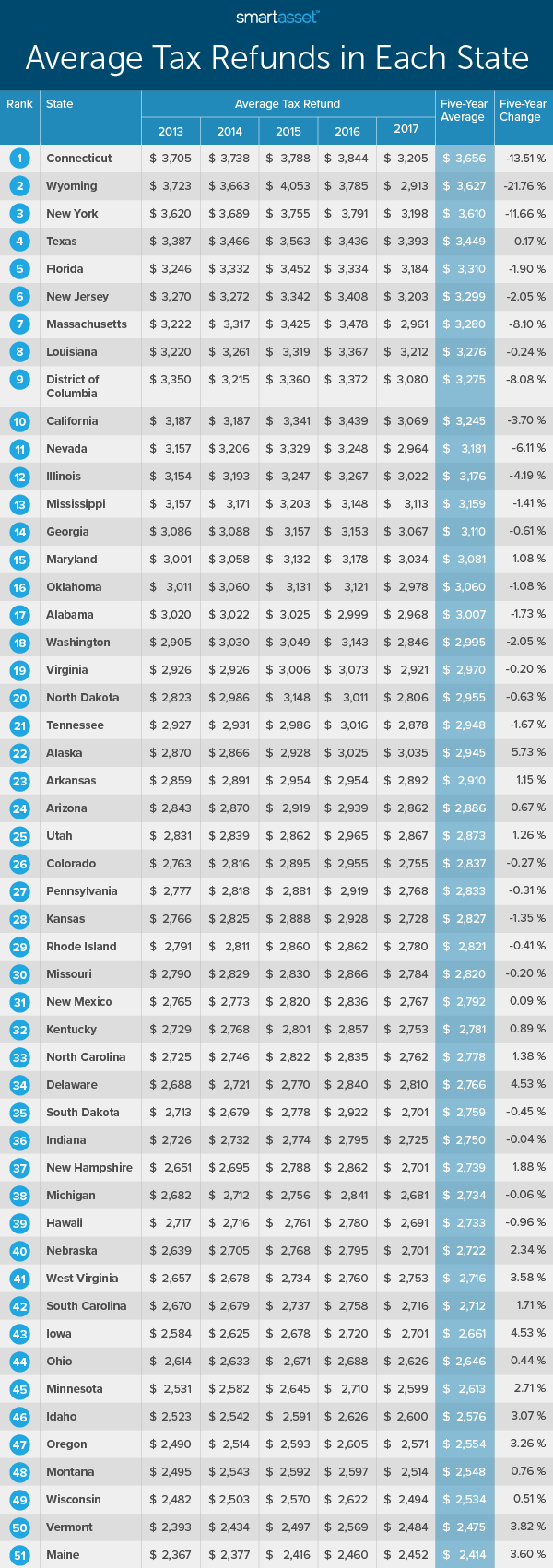

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

IRS TAX REFUND.

. Refund for unemployment tax break. If you dont have that it likely means the IRS hasnt processed your return yet. Another way is to check your tax transcript if you have an online account with the IRS.

After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. By telephone at 317-232-2240 Option 3 to access the automated refund line.

The systems are updated once every 24 hours. In order to use this application your browser must be configured to accept session cookies. The EITC is designed to help low to moderate income workers and families get a tax break.

The Earned Income Tax Credit has nearly tripled from 540 to up to 1500 for 17 million workers without dependent children. Sadly you cant track the cash in the way you can track other tax refunds. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal.

Tracing a Refund Check Thats Gone Missing. Using the IRS tool Wheres My. Social Security number of taxpayer.

The first way to get clues about your refund is to try the IRS online tracker applications. 10200 x 2 x 012 2448. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

You can ask the IRS to trace it by calling 800-829-1954 or by filling out and sending in Form 3911 the Taxpayer Statement Regarding Refund. Visit IRSgov and log in to your account. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was applicable for. To take advantage of the useful resources you will simply need to. This calculator is updated with rates and information for your 2020 taxes which youll file in 2021.

If you havent opened an account with the IRS this will take some time as. Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. How to calculate your unemployment benefits tax refund.

When do we receive this unemployment tax break refund. Theres a process in place in case you lose your paper check or if it goes missing. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. Generally the IRS issues most refunds in less than 21 days but some may take longer. Get your tax refund up to 5 days early.

To access the Wheres My Refund tool you need to enter your Social Security number or individual taxpayer identification number the filing status used on your 2021 tax return and the exact. Heres how to check your tax transcript online. All times are estimated by IRS I mailed my paper return STEP 1.

You can call the IRS to check on the status of your refund. Tax refund After the IRS accepts your return it typically takes about 21 days to get your refund. If you are among the millions of Americans waiting for the money you can check the payments status by using the IRS Check My Refund Status tool which is designed to people track the status of.

Two ways to check the status of a refund. How To Track Your Refund And Check Your Tax Transcript. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

Download the IRS2Go app to check your refund status. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5.

So our calculation looks something like this. The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support. How to claim an unemployment tax refund and how to check the IRS payment status The American Rescue Plan provided a significant tax break for those who received unemployment.

How to Check the Status of Your Refund What youll need. Check For the Latest Updates and Resources Throughout The Tax Season. Make sure its been at least 24 hours or up to four weeks if you mailed your return before you start tracking your refund.

Please allow 2-3 weeks of processing time before calling. Exact amount of the refund. What You Will Need Social security number or ITIN Your filing status Your exact refund amount Check My Refund Status Wheres My Refund.

To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. The IRS will determine whether the check was cashed. If those tools dont provide information on the status of your unemployment tax refund.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. Please ensure that support for session cookies is enabled in your browser. However IRS live phone assistance is extremely limited at this time.

Those who file an amended return should check out the Wheres My Amended Return. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. The Wheres My Refund tool can be accessed hereIf you filed an amended return you can check the Amended Return Status tool.

IRSnews IRSnews May 10 2021 But you can track the state of your tax refund using the IRS online portal Wheres My Refund. This is the fastest and easiest way to track your refund. Based on your current information we project that you will owe 5442 in federal taxes.

The child tax credit checks began going out in july and will continue monthly through december for eligible families.

Where S My Refund Eyewitness News

Irsnews On Twitter Tax Refund Tax Time Tax Help

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

Where S Your Tax Refund Find Out With Irs Online Tracker Don T Mess With Taxes

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Income Tax Return E Filing E Filing Income Tax Returns Trutax Tax Return Income Tax Return Income Tax

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021